Hope you didn’t have too many presents you wanted to buy… The Costa Rican government wants their holiday present first! Be sure you pay your marchamo vehicle tax by December 31st!

If you own a car in Costa Rica, you probably have heard “marchamo” so many times you envision people marching in a band yelling “Remember the Alamo!” like I do.

Maybe not.

Deadlines for Car Owners in Costa Rica

There are 2 deadlines (maybe 3) each year if you own your own car. Sometimes they get confusing, so here’s a little reminder:

- Marchamo – A simple annual license plate tax that needs to be paid by the end of December.

- RITEVE – An annual vehicle inspection that needs to be performed by the date posted on your windshield – the month is based on the last number of your license plate.

- Additional Insurance – Optional vehicle insurance that can be paid semiannually, quarterly, or monthly.

How to Pay Marchamo?

You can pay your marchamo tax at any bank and pick up your new paperwork right away. Look for signs that say “Paga su marchamo aquí.” You can also pay with most banks online and pick up the paperwork the next day. It’s that simple!

You can pay the marchamo from November 1st through December 31st. There’s a stiff fine if you’re caught driving after the first of the new year without your marchamo paid!

Before heading to the bank, click here to go to the INS main marchamo website to check on your paperwork.

All you need is your license plate number and the security code at the bottom. I found that it sometimes made me put the code in a few times, even if I had it right. Keep the “PARTICULAR” vehicle type selected.

If you’ve paid the tax already, the website will say that the marchamo for your license plate isn’t due – Este vehículo no tiene marchamos pendientes. If it’s still outstanding, the next page will tell you the details of the bill.

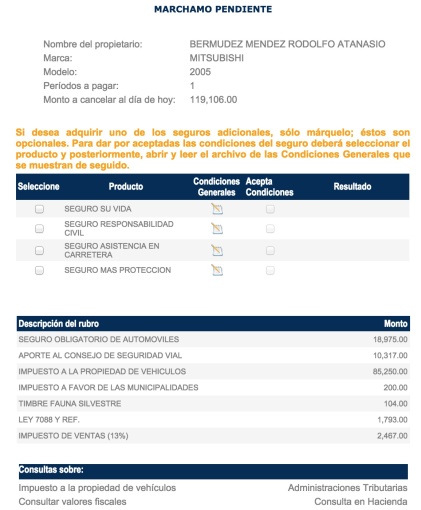

Here’s an example:

There are 3 Important Pieces of Information:

- The name on the title

- The make and year of vehicle

- How much is due

Make sure they are all correct before continuing. Double check the license plate number if something seems off. The name on our title hadn’t been transferred over yet from when we bought the the car, so we had an extra step to change that before paying the tax – more on this below.

Now that you know the amount that is due, you can pay it online or at your favorite bank. Be sure to bring your ID with you (cédula or passport). They may also ask for your current RITEVE.

When you’re finished, be sure to keep the new registration paper in the car at all times and put the new sticker on your windshield.

The Reality of Paying Marchamo

We’ve had our car less than a year, so this was a new experience for us. It seems like a pretty simple process – just pay a tax, right? But still, it took a few hours, a lot of lines, and a lot of steps – the Tico specialty. Every person’s situation is different, but this is what we encountered.

We went to Banco Nacional in Grecia to pay our marchamo tax. I knew how much it was and had the cash on me. They had a “Pay your marchamo here” station right inside the bank – awesome!

Buuuuut, the lady was at lunch, so rather than waiting a half hour for her to finish her hamburger we went to another caja in the bank to pay the tax. The bank teller showed me his screen, and it still had the name of the prior owner on it. I saw this online earlier, but thought is was wrong, nope. They hadn’t changed it in the main system yet since we bought out car months ago – someone along the line dropped the ball for some reason.

It didn’t really matter who’s name was on the registration because I had a title with my name on it. The teller said I could change it right in the bank, so to avoid hassles in the future I decided that was best. He sent us in the back to find Emilio, who was really nice and took just a minute to change the name in the system. We’re starting to get somewhere now!

I trotted back to the same teller and yep, sure enough my name was on the title! I paid the tax and took the receipt to the next station in the back of the bank again to pick up the new registration papers. By now everyone’s wondering if my wife and I are just making laps around the bank for exercise!

The window in the back had a sign above it that said Retire su marchamo aquí – pick up your marchamo paperwork here. We gave her our receipt and she gave us the new registration card and a sticker for the window.

Whew, finally finished the maze! Should be faster next time!

What IS the Marchamo Tax?

The marchamo tax is similar to paying the registration and license plate tags in the US. Here in Costa Rica it covers mandatory basic liability insurance, road safety tax, property tax, city tax, wildlife tax, law 7088 tax, and a 13% sales tax for only the mandatory liability insurance for some reason.

All the fees are the same for all cars except for the the property tax, which is the largest portion.

How Much Does Marchamo Cost?

The marchamo cost mainly depends on the valor fiscal, the tax value that the Costa Rican government puts on the car.

For example, I have a 2000 Tundra with a valor fiscal of c4,100,000 and the total marchamo tax is 113,000 colónes (about $210).

A newer example – a 2011 Hyundai Tuscon with a valor fiscal of c13,000,000 has a total marchamo tax of c393,356 ($740).

At least you’ll have a rough idea of how much you’ll need to pay from these examples.

Good luck paying your marchamo and driving in Costa Rica!

Leave a comment below if you’ve come across anything different or new!

Greetings! Very helpful advice within this post!

Thanks for sharing!