Ok, so we’ve finally decided to move abroad to another country. So far we have an idea when we’re going to leave and would like to be gone long enough to make it worthwhile.

How do we plan for something this vague?

Most importantly, can we really afford it?

Like responsible young adults, we decided to make a budget for our trip. We wanted to make sure we wouldn’t run out of money and be forced to come back home in 2 months – didn’t want to live in our parent’s basement and eat rice for a year because we blew our life savings… Good idea.

I put together a rough daily budget from our prior traveling experience and some travel guides, but there was one missing piece in the formula – how long will we be gone? How do we budget for our open-ended trip?

It’s easy – you just make a daily budget and divide your life savings by the cost per day. Voila, you have found the magic number of how long you can be gone!

You’d probably quit reading this blog right now if I said that’s all there was to it.

Digging Deeper

Being an engineer and not wanting to sleep on my parents’ couch motivated me to dig a little deeper. There were so many more “leaks” in our bank account than we had imagined!

The best way to begin this Open-Ended Budget is to start at the end and work backward and see how much money is left over. This means starting with a safety fund, then the things that must be paid first like insurance and taxes, and then end with your trip cost. You’ll get a chance to revise your daily budget, so keep reading.

First, a note about credit cards. Every section in this budget could be trumped with the phrase “I’ll just put it on my credit card and pay it off when I get back.” That is the quickest way to start the avalanche of a life of credit card debt. The statistics are scary enough – Average credit card debt per household: $15,800, and more than half of them carried a balance between years1. An interest rate of 20%+ is ridiculous! Spend your money traveling – not paying some big bank to slip bribes to the US government!

I want to show how to travel within your means, not have a good time traveling for a year and then regret it for the next 10 years. It’s easy though, and gives you an awesome motivation to start saving now! For starters we thought we should plan for living abroad one year, and also wanted to take a 3 month trip somewhere along the line.

Here’s how we broke it down

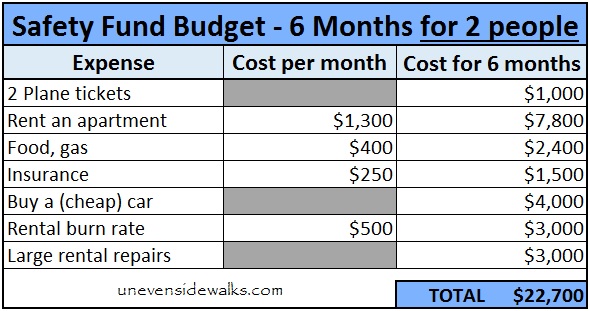

Safety Fund – First of all, we wanted a safety fund stash so we could return to the US and start up our lives again (i.e. not sleep on friends’ couches). It’s recommended to have 3-6 months of expenses saved up. We opted for a conservative approach since the economy isn’t the greatest for finding a job, and then added on a few more things. Here’s how it turned out:

- 2 plane tickets to return home – emergency return trip home or when we’re done traveling

- 6 months of rent for a reasonable apartment (depending on where we might end up) while we find a house, a job, and get settled once again

- 6 months of food and gas to find a job – a rough guess so it didn’t get forgotten

- Health and Car Insurance – another rough guess

- Car from craigslist – we are car-less hitchhikers, so we’d need to buy a car when we return to the US. We don’t want to rely on friends or family for more than a few rides, and again we don’t know if we will return close to either of those.

- Rental house – we left with a rental house in San Diego, so we wanted to make sure there was enough money in the bank to keep that running. We also included money to make a large repair if something came up so it wouldn’t be the last straw to break the camel’s back.

So, $22,700 is in our piggy bank if we ever have to abort our trip. It seems like a lot, and it is. It helps us sleep well at night knowing that no matter what happens we will always have enough to re-start our life back in the US.

It is a good idea to keep your safety fund in a separate bank account – both to keep it safe from debit card thieves and also so it isn’t even there when you look at how much money you have left for your trip. Once you decide on an amount, don’t ever convince yourself later down the road to dip into it for any other reason.

Since it is quite a bit of money to just leave laying around, I’ve convinced myself of one deviation to this rule. I’ll allow myself to invest up to half of the amount so I can make more than 0.5% in interest with it in the bank. This doesn’t mean go gamble with it, but be smart and keep tabs on it wherever you invest it.

This “safety fund” is a foreign concept to many people since so many people in the US are under water with their debt.

Burn Rate

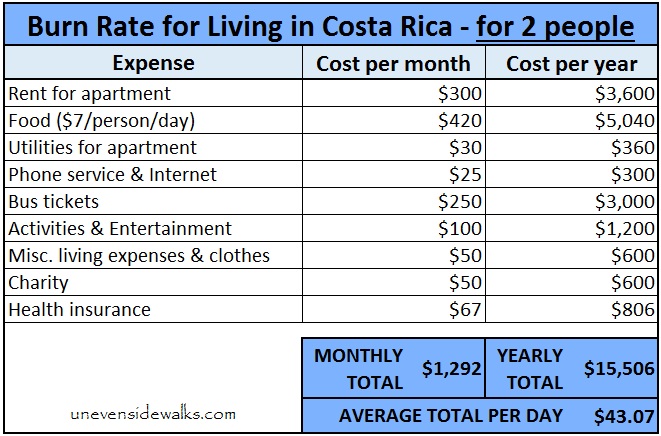

Money Burn Rate for 2 People Living in Costa Rica – We had traveled down south a bit before, so I had an idea of the daily costs we might expect when I first made this table on the back of a napkin. I updated it slightly after a few months to agree with our actual spending that we were tracking.

This budget is specific for us living in Costa Rica rather than traveling here on vacation because we are renting an apartment which is quite a bit cheaper than staying in a hostel. We also didn’t allocate much money for monthly activities and entertainment to save money. We just use that money for small tours and once to go to the beaches for Alyssa’s birthday. The food budget seems low, but we are actually under it each month – even eating in restaurants once and awhile. We save a lot of money cooking simple foods in our apartment.

For phones, we paid for one monthly SIM card that included unlimited internet and another rechargeable SIM that we used for phone calls. Read more about using your cell phone here.

We had planned on traveling to our church meetings in various places at least once a week, so our transportation costs are a bit high for someone who may just stay in one area. Sometimes we paid for small things for our friends like a meal or a bus ride, so we tracked that as a charity. We bought a year of health insurance before we left, but figured we need to track it with our expenses as well.

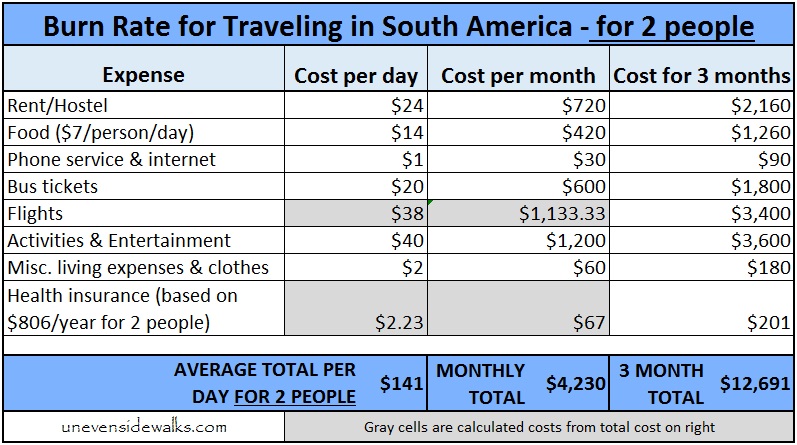

Burn Rate for 2 People Traveling in South America

This budget is more geared to traveling because hostels are quite and we plan on riding a lot of buses to move around some pretty big countries. We updated our budget with our actual flights, so those are exact numbers. Since our trip is 3 months long, I divided by 3 to get an idea of the monthly cost and then by 30 for a daily cost. The Activities and Entertainment is high because we plan on taking some tours that will be relatively pricey. We are splurging on this trip much more than in our living budget because this is our “vacation.”

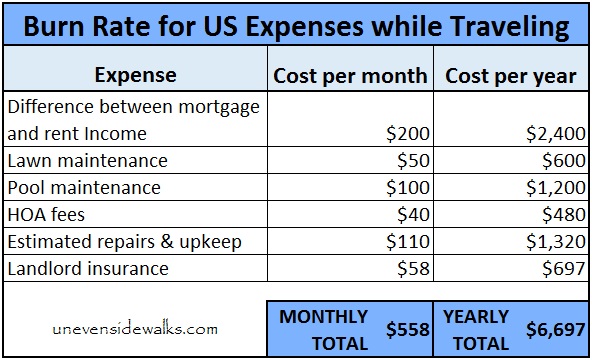

Burn Rate for U.S. Rental House

We have a rental house in the US, so we have a small drain on our bank account that we need to account for. If you have a rental property, your costs will vary depending on your exact situation. We included a line for unanticipated repairs so we wouldn’t be grumpy when we get a repair bill after the tenants flush a barbie down the toilet.

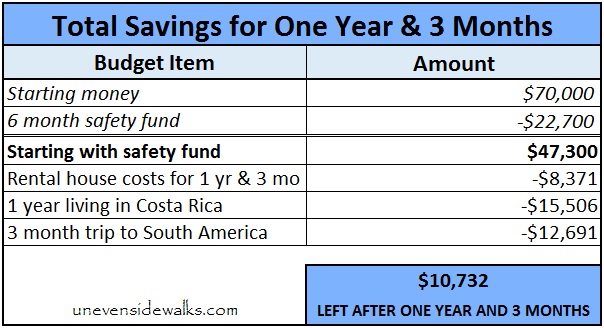

Adding it all up

At last, we figured we had a pretty good budget that was conservative in every way possible. We left the USA without a job or any idea of what we’d be doing to make money, so we planned for the possibility of not making a dime for a whole year. We knew that we would figure something out before then, but a year seemed to be a good conservative plan. We had allocated a 6 month safety fund, 2 plane tickets back home, 1 year of living expenses in Costa Rica, 3 months of vacation in South America, and 1 year, 3 months of US expenses – all for two people.

We’ll just pick a number that someone might have in the bank after saving hard for a few years and selling everything they own: how about $70,000?

The total left at the bottom makes it look like we used up our entire life savings to go on this trip of a lifetime, but that’s just the amount we would have left to spend at the end of it all. Remember, this is a worst-case scenario without working at all, and is not likely. The safety fund was a pretty big chunk of our savings and that is still safe and sound. We have it in a separate bank account so it is out-of sight and out-of-mind so we don’t think of it as money to spend. That’s the reason I put it as bold because it’s helpful to think of the bold number as all we have left.

It was a pretty good feeling to have it all laid out so we could convince ourselves at last that we would have enough money to be able to explore another part of the world and go on this trip of a lifetime.

Why so Complicated?

Most budgets will be simpler than ours because we needed to take into account a rental house in the USA, living without pay for a year in Costa Rica, and a 3 month “vacation” trip around South America. I wanted to put our entire budget here so people could see exactly what we did, what worked, and what didn’t work for us.

Most people don’t have a safety fund and just travel on their last bit of savings. Most travel blogs encourage this by just talking only about how much a trip costs without considering all the “leaks” that are in a normal bank account. We made it a point to save as much as possible for the past 4 years so we could take a trip like this and not dig ourselves into a hole of debt. Also, keep in mind that traveling around the world isn’t a reason to dip into your retirement plans. Those are for later on in life.

Be sure to read our other posts about selling all our things!

Sources: 1. http://www.statisticbrain.com/credit-card-debt-statistics

We hope this helps you plan a budget for your open-ended trip traveling around the world! If it’s not in the plans for this year, we hope it’s a little motivation for someday soon!

awesome list guys.. i do same thing.. my main concern about me travelling i always over spend hahahahahaha specially asian countries.. i always over spend..